One year after the conclusion of the Auto Finance Data Pilot project, in January the Consumer Financial Protection Bureau proposed an expansion of data collected from lenders servicing direct and indirect auto loans. If the proposal succeeds, auto lenders servicing 20,000 loans or more per year would be required to report expanded details about each loan underwritten, including details regarding dealership margin, fees and F&I products included in indirect loans.

According to Automotive News, the CFPB requested the nine pilot lenders to disclose an expanded data set for their auto loans, including:

The focus on fees, service and maintenance plans in the proposal certainly raises an eyebrow. Dealership disparate lending practices have been the focus of the FTC in the past 2-3 years, and they have pursued large and small dealerships for fair lending violations relative to their dealer reserves. Gathering data on the fees and products included in financing certainly opens the door for regulations to be applied to variances discovered in these items as well.

According to the same article, it is unclear whether the CFPB will seek new regulations for lenders originating auto loans or seek to publicly disclose the data as is the case under the Home Mortgage Disclosure act. However, there is some concern that the CFPB would share the conclusions it draws from the data with other federal agencies. The CFPB regulates lenders, not dealerships… but they could certainly tip the FTC about any trends they are gathering about a particular dealership’s indirect loans.

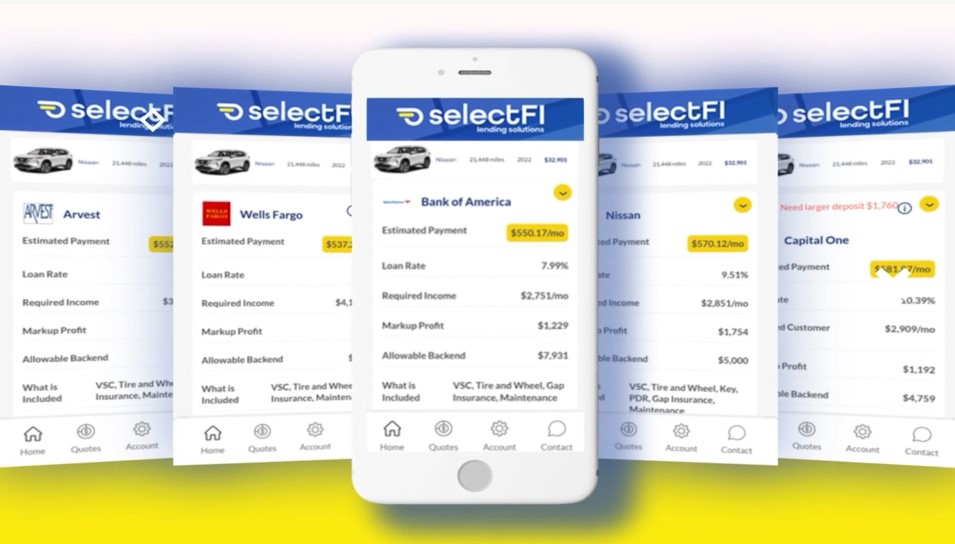

"It's our view that this steps the CFPB towards automation that will detect disparate impact in indirect auto lending at scale and broadens regulation beyond dealer reserve," said Drew Dorn, Chief Operating Officer at SelectFI. "Inevitably, dealerships will face more pressure from lenders and regulators to meet fair lending standards."

With the stakes rising and every transaction under scrutiny, how will dealerships most likely be impacted by regulations granted by the CFPB proposal?

Expect Lenders to Tighten Their Standards and Increase Investigations, Costing Your Team Time

Facing these new requirements for indirect loan data disclosure and much in advance of required disclosure to the CFPB, large lenders will likely expand their automation to detect unfair lending practices in dealer reserve to include pass-through fees and backend product and service sales. If the CFPB proposal is approved, their risks increase significantly for indirect programs if they do not monitor the fees and backend sales for disparate practices.

That means dealerships should get used to more investigations and auditing from lenders. Many dealerships have already contended with lender investigations when any disparate lending trends emerge. The effort behind them is costly to dealership team productivity, where they will invest a lot of time sorting through dealership DMS systems or even paper deal jackets to determine the details of each transaction in question.

Pass-through fees and backend products and services built into financing may be considered disparately applied if a protected class is perceived to have a higher penetration rate or margin on the transaction. Lenders will demand more concrete details on internal processes, controls and documentation related to the sale of these products to support their lending positions. How dealers will need to support their fees and backed sales isn’t clear, but they should certainly be ready to defend their positions.

More Lenders Will Leave the Indirect Lending Space, or be more Selective about the Dealerships They Service

In recent years, large and small lenders alike have shown less appetite for indirect lending. Some industry leaders such as Citizens Bank, Key Bank, BMO, and others have significantly scaled back their participation or completely withdrawn from the indirect lending marketplace citing too much risk from rising default rates. Other lenders such as Fifth Third have reduced their exposure by offering lending only to top credit tiers or with structures that are difficult to achieve for the average consumer. SelectFI has certainly observed this trend across national lenders, and a strong desire from dealership clients to lean on local banks and credit unions to expand opportunities for their buyers.

The greatest threat to dealerships is any loss of core lenders in their portfolio. The average dealership has 18 lenders to draw from, so the loss of even one can make a significant difference in options for customers and ultimately sales for dealerships. Lenders have been known to leverage this position to change dealership behaviors, and even completely cancel the lender agreement for repeat offenses.

Dealerships Become Targets for Regulatory Agencies

The consideration that the CFPB may share the data and trends they aggregate from indirect lending is ominous. The CFPB is a willing collaborator with the FTC to enforce fair lending regulations.

In states which have their own fair lending regulations and where they are more stringent than federal regulations, state attorneys general become the enforcement arm. According to Cox Automotive’s 2024 Compliance Guide:

"Although federal law addresses most consumer financial services topics, states are also active in regulation. Under the doctrine of "preemption," certain federal laws, including the Federal Arbitration Act, TILA, ECOA, and FCRA will preempt and override inconsistent state laws on the same subject. However, states that have laws that are not covered by federal law, or are more restrictive than their federal counterpart, are not subject to preemption and will be enforceable by the states."

Typically regulators act on evidence found among several customers that report concerns and expand their evidence collection by auditing dealership records and cross referencing proxy data to surface disparate classes (a process that has been the target of deserved criticism). However, it is conceivable that they could act on data trends as evidence and prosecute dealerships and indirect lenders directly. Even though the CFPB doesn’t have jurisdiction over auto dealerships, it could easily pass of the data it collects off to the FTC and state AGs to act on.