On August 15, 2024, the Federal Trade Commission (FTC) and the State of Arizona Office of the Attorney General jointly filed a lawsuit against Coulter Motor Company, an Arizona-based auto dealership. The legal action centers on accusations of deceptive and discriminatory practices in the dealership’s advertising, pricing, and sales processes. Coulter Motor Company, like other dealerships facing similar FTC lawsuits, has denied the allegations but has agreed to pay $2.6 million to settle. The settlement cited the need to avoid the high costs and effort associated with prolonged litigation, which has been common in many of the lawsuits filed against dealerships (such as the Passport Auto action and Napleton action in 2022).

The Allegations

The first two key accusations against Coulter cited practices of deceptive pricing as a bait-and-switch tactic to lure in consumers, and that consumers were charged for unauthorized add-ons in their financing. These accusations suggest an organized and procedural effort across the entire organization, not inconsistencies that may have inadvertently affected any particular class of customer. Quite honestly, our services wouldn’t have helped Coulter mask any intent to deceive customers or avoid these allegations.

However, the third and key allegation in the joint action was that Latino consumers at Coulter reportedly paid an average of $1,200 more in interest on finance deals and add-on charges compared to non-Latino White customers. Regardless of any intent Coulter may have had, this is where our services might have had direct value for them... and any dealership. The financing process is prone to human error and inconsistency, and the reality is that regulators don’t permit any margin for error.

The FTC Considers Dealerships Lenders

Dealerships have complex indirect lending relationships with banks, captive finance companies, and credit unions. Due to the nature of how customers agree to purchase a vehicle before funding from a creditor is secured, the FTC views dealerships as lenders and holds them to the same stringent standards as those financial institutions. Navigating this correctly demands robust legal and compliance resources, as well as strict adherence to a process that most dealership employees are unaware of.

Step 1: Adopt a Fair Lending Policy

One of the most effective defenses against the type of regulatory scrutiny faced by Coulter is the adoption of the National Automobile Dealers Association (NADA) Fair Lending Policy. The NADA has dedicated tremendous resources to develop a framework intended to keep dealerships compliant with the ECOA and other relevant regulations. By implementing a structured process for quoting payments to customers, dealerships can minimize the risk of disparate impact in their lending decisions.

Step 2: Engage SelectFI to Tighten Your Procedure for Quoting Payments

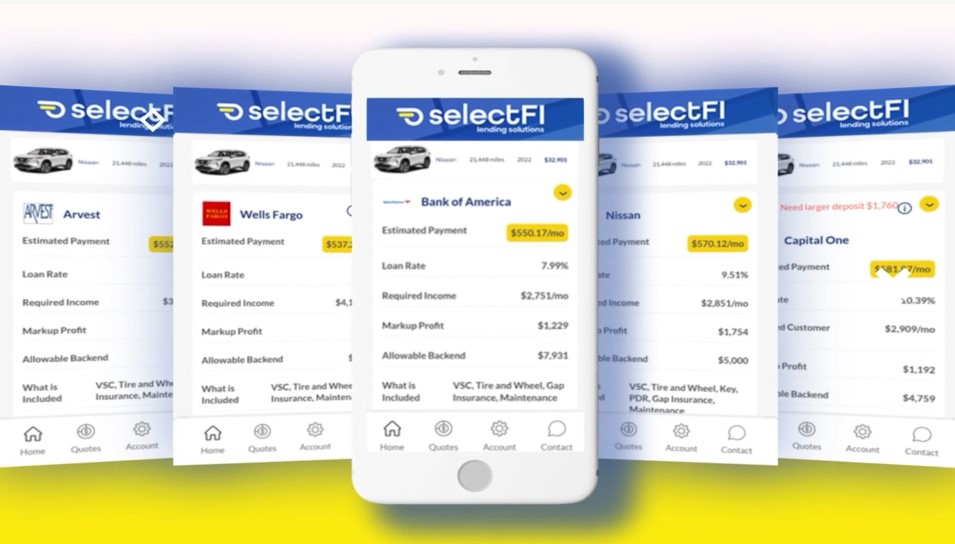

SelectFI provides tools that can help dealerships implement these best practices, allowing dealerships to provide customers with payment quotes based on real credit information. This platform analyzes historical data on how lenders have approved customers with similar profiles and deal structures, considering factors such as creditworthiness and collateral. We predict the rates and terms that lenders are likely to offer, putting dealerships in a much better position to structure their deals.

When deals can be structured from the outset, dealership sales and finance teams are finally able to align. This reduces the need to renegotiate or restructure deals, which erodes profit margins and leads to customer dissatisfaction. More importantly, it ensures that dealerships are using a structured and unbiased process that protects them from the kind of regulatory actions like those Coulter Motor Company now faces.