The process of quoting financing rates can be a murky area, with dealerships making decisions based on factors that may not always align with regulatory standards. Let's explore four common pitfalls that dealerships encounter when it comes to quoting without checking credit, making presumptions about lenders, and more – and how our cutting-edge fair lending compliance software is revolutionizing the game.

Quoting without Checking Credit

A potential buyer walks onto the showroom floor, eyes shiny with excitement. The sales team, armed with experience, quotes a financing rate based on a few questions they ask the customer about their credit. It's a bold move that can either result in a seamless transaction or a tumultuous ride filled with unexpected bumps.

Some dealerships rely on superficial customer judgments like appearance, car, or previous financing history. While seemingly efficient, this approach often results in biased decisions and unfair treatment. Enter the era of data-driven decisions, where advanced software analyzes credit profiles to ensure that every quote is based on accurate information rather than assumptions.

Quoting Standard Rates

To simplify the quoting process and to avoid any accusation of bias, some dealerships use standard rates for every customer... a one-size-fits-all approach that is costly and technically non-compliant. For example, some dealerships answer lending compliance by setting a rate they will quote every customer, say 9%. But this shortcut comes at a cost and often excludes certain customers from approval, raising compliance red flags. The 9% rate might have been a comfortable average at one point, but it's a recipe for disparity in the dynamic world of lending.

Failing to Document Deviations

The art of negotiation is unpredictable, and the first pencil rarely becomes the final agreement. Fair lending regulations mandate that any deviation in standard mark-up must be thoroughly documented and reviewed by the dealership's program coordinator. Failure to adhere to this requirement can lead to severe consequences.

To mitigate this risk, our Predictive Lending™ software streamlines the documentation process, making it easier for dealerships to track and record deviations. The process ensures compliance and provides a transparent trail for internal reviews and external audits if they arise.Presumptions about Lenders

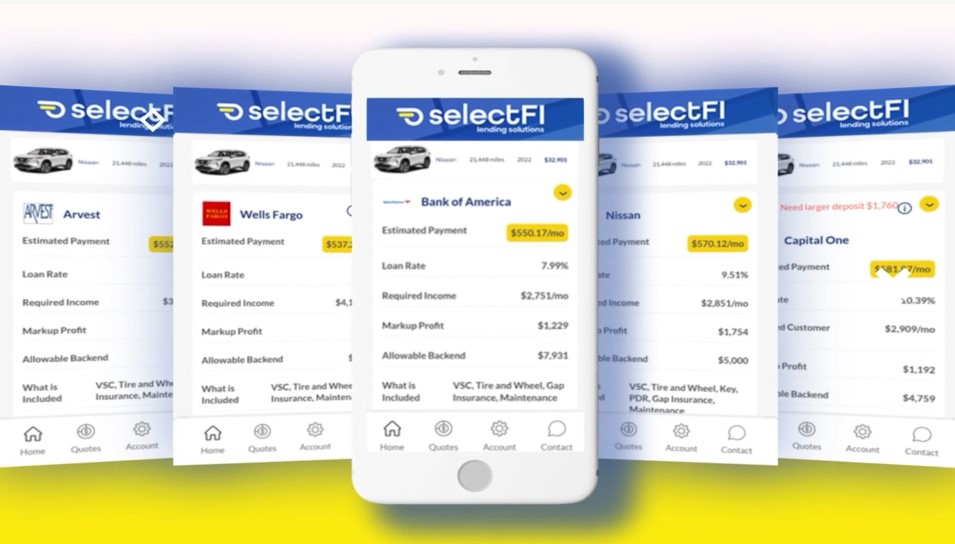

Dealerships often get comfortable with a select group of lenders, submitting applications based on manual evaluations of credit and collateral. While convenient, this approach may cause them to miss out on better deals offered by lenders beyond their usual scope.

Lenders are frequently changing their guidelines and rates to balance their portfolio and risk, making it challenging for finance managers to rely on trends or impressions when determining the best financing options. The latest software in the market eliminates this guesswork, automating the process and expanding the horizon of available lenders to ensure that the best options are always considered.