In the dynamic world of auto financing, 2024 promises to be a year of transformation. Change is on the horizon, with predictions that could reshape the way lenders operate and consumers navigate the world of vehicle financing. Buckle up as we unveil the road map for the upcoming changes, from interest rate dynamics to the evolution of vehicle inventory and share a forecast of success for one industry trailblazer – SelectFI.

A Tale of Prime and Subprime Borrowers

The Federal Reserve might be done raising interest rates, but the ripples of change are far from settled. Our prediction? Lender interest rates are set to decline for prime borrowers, offering a silver lining for those with strong credit histories. However, the road diverges for subprime borrowers.

National lenders, it seems, are steering clear of an appetite for subprime loans. A conservative posture is anticipated for 2024, grounded in two compelling reasons. First, delinquencies are making a comeback, marking the first rise since the pandemic stimulus in 2020. Second, the Fed's decision to discontinue student loan forgiveness programs last October has significantly reduced available income for young auto shoppers with student loans, categorizing them as subprime borrowers.

During the pandemic, lenders extended a helping hand to in-between borrowers, creating a "near prime" tier. Favorable terms and increased loan-to-value limits were the order of the day. Fast forward to 2024, and we predict the near prime tier will soon fade away, leaving only the prime and subprime tiers. Financing subprime borrowers is projected to be a challenging endeavor.

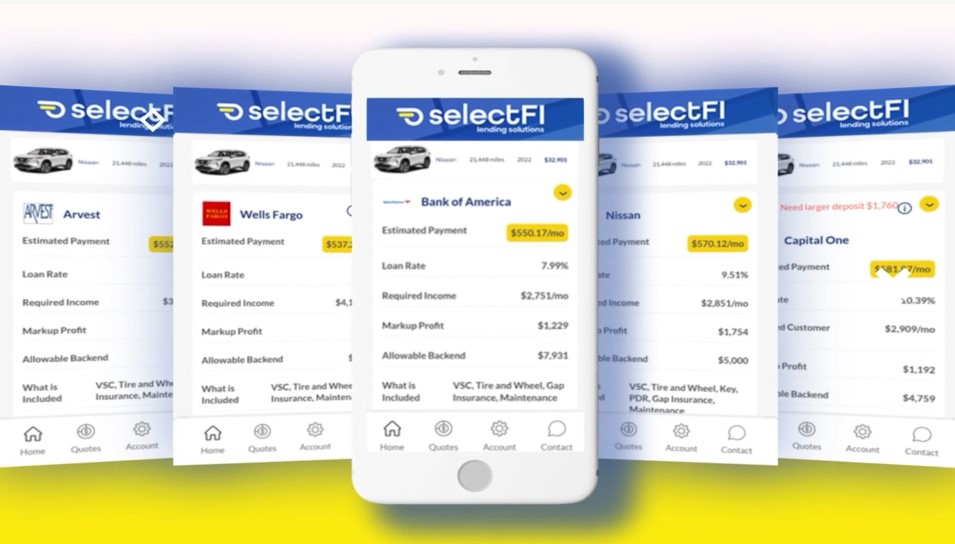

Using our Lender Selector® product, dealers can effectively eliminate bias from the lending process. Lender Selector makes data-driven decisions based on lender criteria, customer-specific metrics, and the vehicle being financed, making it a true fair lending compliance software.

Shifting Gears in Affordability

As consumers hit the showroom floor, the inventory landscape is undergoing a transformation. New car inventory available to dealers is on an upward trajectory, a trend anticipated to continue from the strides made in the second half of 2023. However, a storm is brewing on the affordability front.

The auto industry is grappling with surging labor costs and material expenses, and the impact is bound to be felt in the retail prices of new vehicles. But fear not, for there's a silver lining. Certified pre-owned vehicles are set to take center stage, capturing the hearts of consumers with their more wallet-friendly price point.

Anticipate manufacturers extending their certification to older vehicles beyond the current three-year limit and picture this: five and six-year-old used vehicles becoming certified gems after meticulous inspection, providing a cost-effective alternative to savvy consumers.

Accelerating Toward Triumph

Amidst the whirlwind of industry changes, there emerges a beacon of success – SelectFI. We predict the early closure of our pre-seed fundraising efforts in Q1, laying the groundwork for an impressive capital foundation that will echo through 2025. With the financial hurdle cleared, we’re focusing on continuing to innovate our Lender Selector solutions, enhance our customer support, and expand our reach to new dealerships.

Our success story in 2024 isn't just a mere projection; it's a commitment. We anticipate quadrupling our revenue, showcasing the strength of our vision and the confidence investors place in our potential. Our success becomes intertwined with the success of dealerships and consumers alike.

The Road Ahead

As we navigate the twists and turns of 2024, the auto financing industry is no exception. Interest rates ebb and flow, vehicle inventory takes on new dimensions, and pioneering companies like SelectFI rise to the challenge. The call to action is clear – embrace the changes, explore new possibilities, and look toward the future with confidence.