In the fast-paced world of auto retail, where financial decisions can make or break a deal, there's a game-changing process for dealerships on the rise - Predictive Lending. Behind this revolutionary approach lies a patent-pending software that promises to reshape the way dealerships handle financing by offering unparalleled advantages and efficiency.

Unveiling the Predictive Lending Process

Imagine a scenario where a customer walks into a dealership, eyeing their dream vehicle. Traditionally, the dealership acts as the lender, connecting with various banks and credit unions, known as creditors. In this process, the customer applies for a loan through a credit application, much like the procedure with a bank. This indirect lending relationship between the dealership and the customer is where the magic of Predictive Lending begins.

Once the customer secures approval from a creditor, the dealership facilitates the loan contract and delivers the vehicle. The creditor then funds the loan, transforming into the direct lender to the customer. Even though they don’t hold the long post-funding, dealerships, are obligated to adhere to fair credit requirements, a crucial aspect overseen by the FTC and state regulators.

Decoding the Predictive Lending Algorithm

The heart of this transformative process lies in the Predictive Lending algorithm. Each dealership lender sets guidelines for decision-making on loans, considering parameters ranging from FICO scores and payment history to vehicle valuation and loan terms. Our system, continuously updated with lender guidelines, analyzes these parameters to create accurate payment estimates.

To ensure precision, our team cross-references predictions with actual decision data, making swift adjustments when discrepancies arise. A soft credit pull is then executed, providing an accurate credit profile without affecting the customer's credit score. The vehicle's value, trade-in, down payment, sales tax, and loan term are then considered to determine the full loan amount.

The Power of Predictive Lending Unleashed

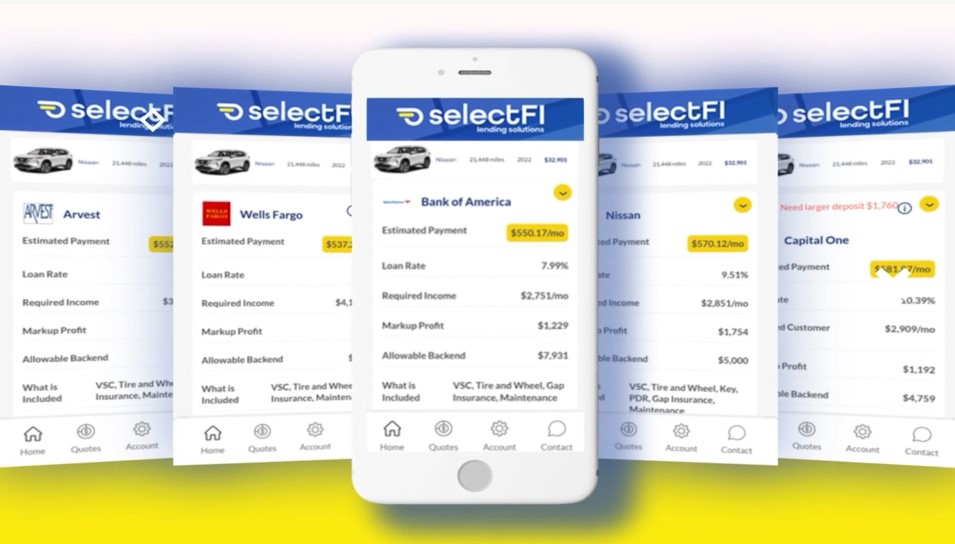

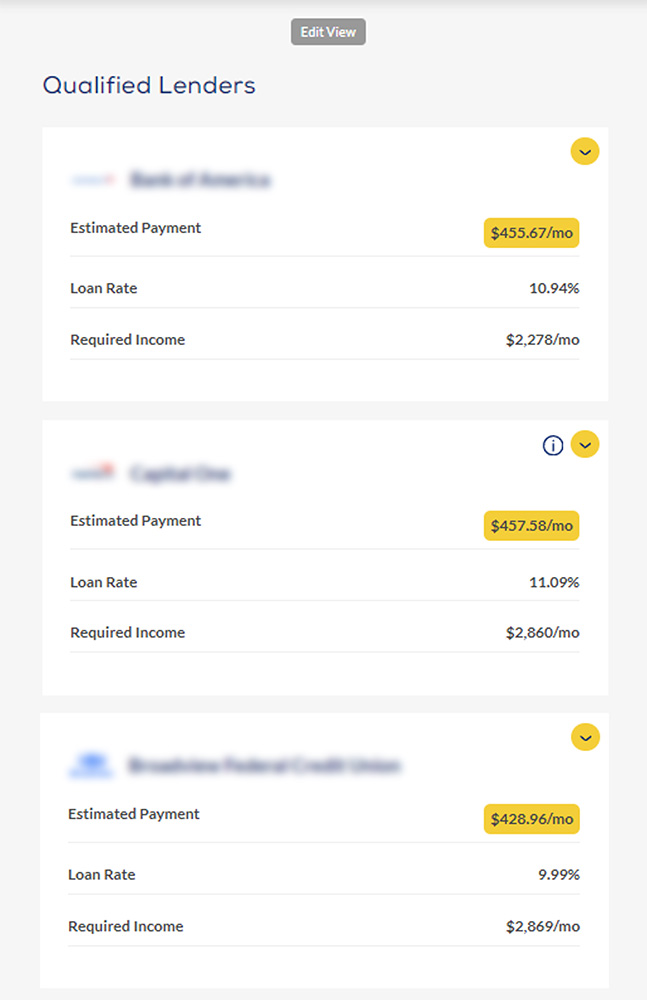

The Predictive Lending algorithm generates a trial loan approval for each dealership lender, simulating their decision for the customer. This yields crucial data, including loan rate, monthly payment, required monthly income, permitted front-end and back-end financing amounts, conditional approvals, and applicable incentives.

The Predictive Lending algorithm generates a trial loan approval for each dealership lender, simulating their decision for the customer. This yields crucial data, including loan rate, monthly payment, required monthly income, permitted front-end and back-end financing amounts, conditional approvals, and applicable incentives.

The top five lenders are then presented to the dealership in order of the best loan rate, providing a clear path to the most advantageous financing options. This comprehensive analysis, completed in a mere 10 seconds, surpasses the conventional method of submitting formal loan applications, which can take up to 36 hours to receive results.

Unparalleled Advantages for Dealerships and Customers

The advantages of Predictive Lending are not only revolutionary but also customer-centric. Unlike traditional methods that necessitate hard credit pulls, this process leaves no impact on the customer's credit score. Dealerships can work closely with customers to find the right payment and vehicle, often securing results that customers can't obtain directly from a lender.

This quick and efficient analysis not only saves time but also standardizes the quoting process for customers. By considering only credit and vehicle value, dealerships can ensure compliance with fair lending regulations. In a market where every second counts, Predictive Lending emerges as a game-changer, providing dealerships with a competitive edge and customers with a streamlined, stress-free financing experience.

Join the Future of Auto Financing

In the realm of auto financing, Predictive Lending is not just a tool; it's a revolution – reshaping the way deals are made and empowering both dealerships and customers in their pursuit of automotive dreams.