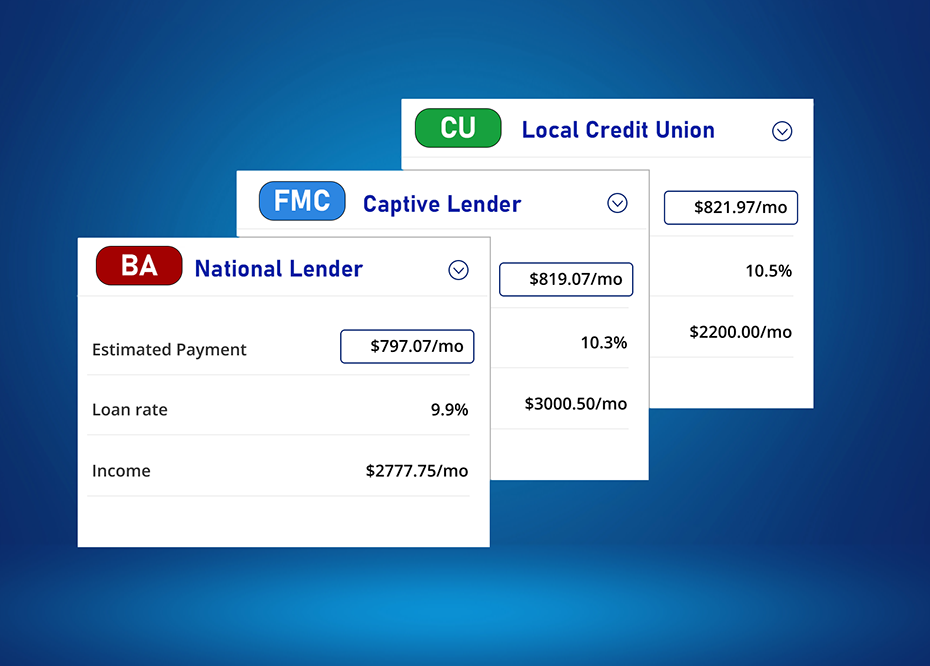

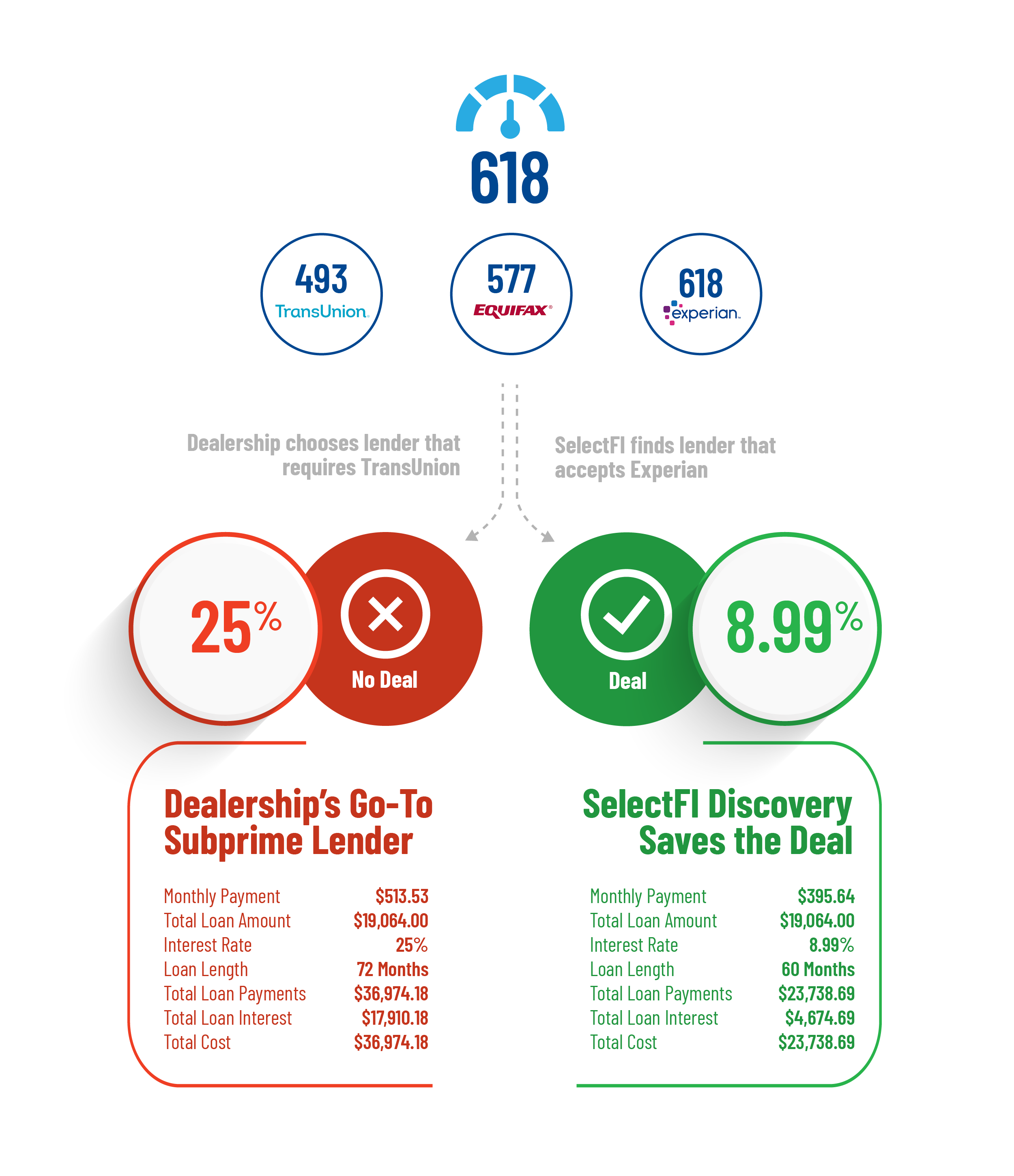

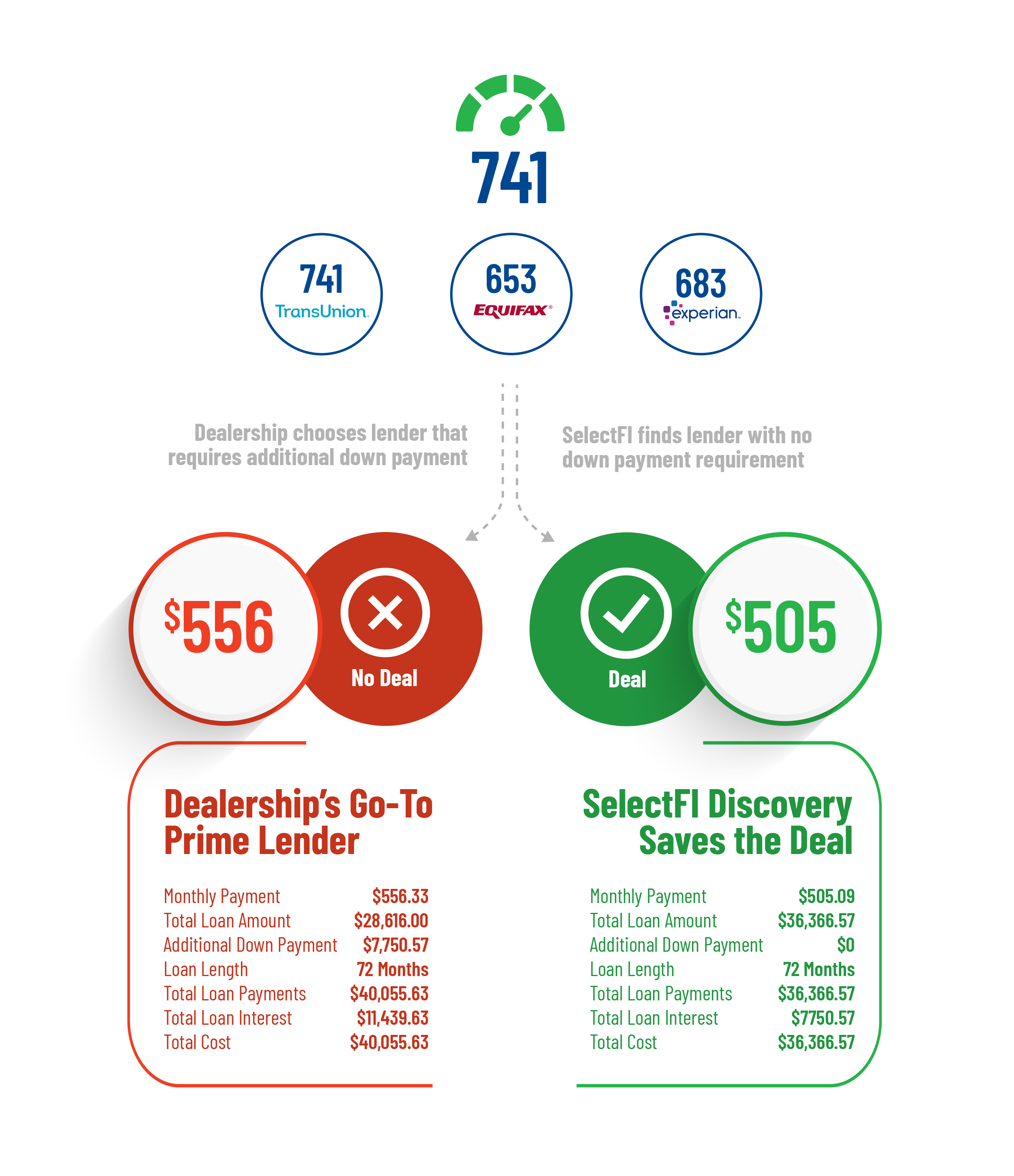

One of Lender Selector®'s superpowers is the ability to improve close rates and revenue by changing a few simple things in the current F&I process. Since its inception, SelectFI was designed to automate small steps and remove barriers that tend to stand in the way of closing deals.